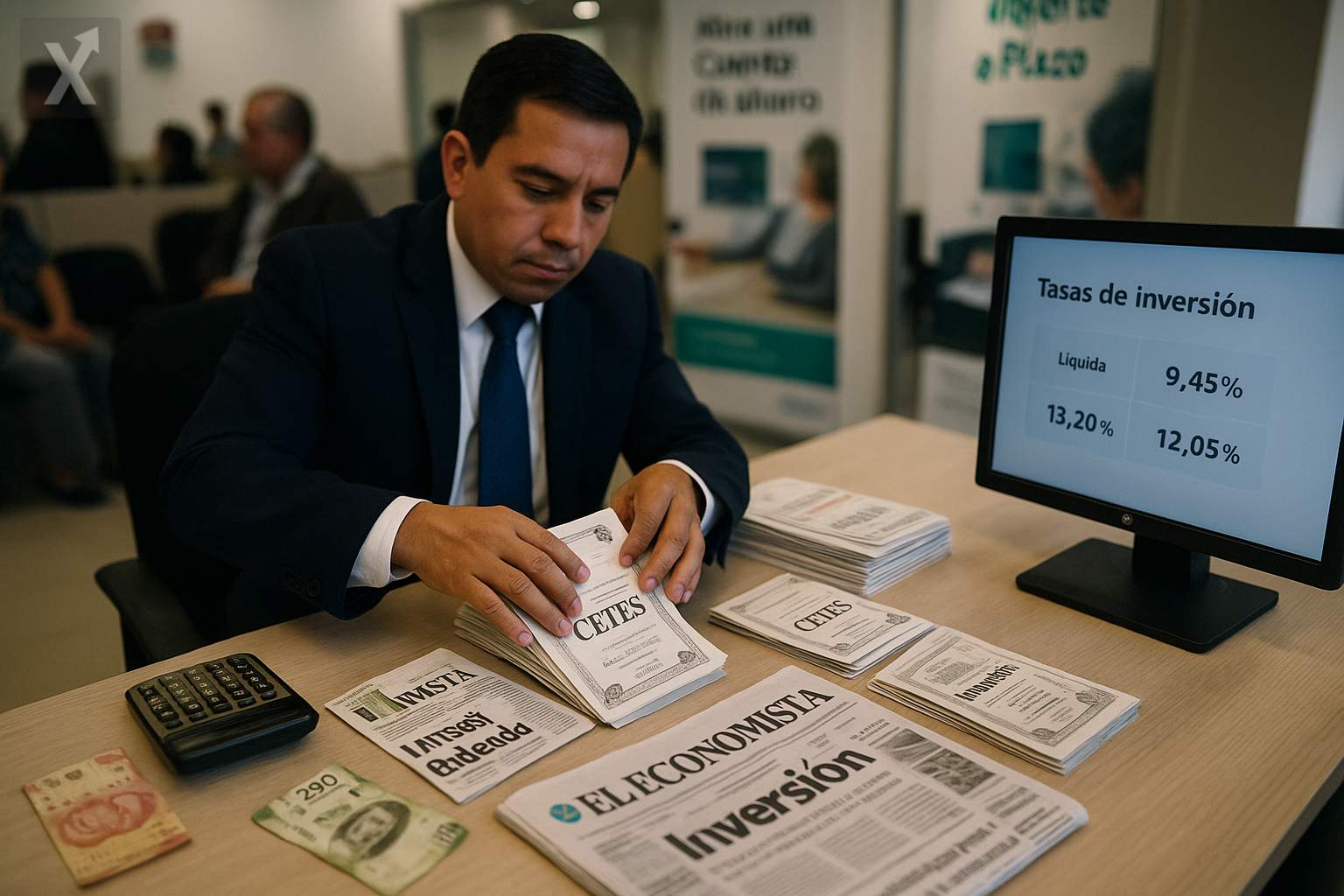

Two-Year Cetes Offer Highest Yields Following Banxico’s Rate Adjustment

In the latest auction of Treasury Certificates (Cetes) held this week, the two-year instrument stood out for recording the highest yield, making it currently the best option for investors seeking returns in the Mexican government debt market. According to information provided by the Bank of Mexico (Banxico), results across different maturities were mixed amid recent changes in monetary policy.

This week’s auction took place following Banxico’s 50 basis point cut to the benchmark interest rate, lowering it to 8%, the lowest level seen since 2022. This adjustment aims to stimulate economic activity in an environment of moderate inflation and a global economic slowdown, but it also impacts the profitability of short-term debt instruments.

Specifically, 28-day Cetes saw a drop in yield, settling at 7.70% after a 0.30 percentage point decrease compared to the previous auction. This downward trend has continued for two consecutive weeks, with a total decrease of 44 basis points according to a report from Banco Base. In contrast, 91-day Cetes saw their rates climb to 8.08%, while 174-day Cetes rose to 8.18%, indicating that investors are seeking better returns by extending their investment horizons.

The highlight of the session was the two-year instrument, offering an annual yield of 8.60%. This positions it as the most attractive option within the portfolio of Mexican government debt for those who prioritize a balance between maturity and profitability.

The yield trend reflects both the central bank’s interest rate movements and investors’ expectations regarding the future of the economy and inflation. Additionally, although inflation has shown signs of moderation in early 2024, Banxico maintains a cautious stance given the still-uncertain global environment and external pressures such as oil prices and international financial conditions.

In the short term, Cetes yields are expected to continue adjusting as Banxico determines the pace of interest rate cuts, in an economy striving to reignite consumption and investment after lingering effects from previous years’ rate hikes. For investors, longer-term instruments may continue to present an attractive opportunity, as long as macroeconomic stability is maintained and inflation remains under control.

In summary, the current environment underscores the importance of closely monitoring reference rate trends and government security auction results, as they reflect both the pulse of the national economy and the expectations of the financial market. For now, two-year Cetes appear to be an attractive alternative for investors seeking higher returns with relative security in today’s context.