Mexico’s External Purchases Shift Toward Asia; Government Accelerates Measures to Substitute Imports

For the first time, Mexican imports from Asia have surpassed those from the United States and Canada. Between January and July 2025, imports from Asia totaled $157.03 billion, compared to $152.31 billion from North America, according to official data. China remains the top Asian supplier by value, with $73.71 billion, while Taiwan saw the largest relative increase with an annual jump of 94.8%. In contrast, imports from the U.S. and Canada declined by 5.3% in the same period, highlighting a shift that challenges the narrative of North American integration under USMCA.

This trend is not new: Since 2020, Mexico’s purchases from Asia have narrowed the gap, and by 2024 they were nearly on par with those from North America. The milestone in 2025 cements a change in the composition of foreign trade: the local industry exports more to the U.S., but increasingly sources intermediate and capital goods from Asia. In China’s case, nearly 90% of imports consist of parts, components, and machinery, not final consumer goods, making any sudden reduction in dependence much more complicated.

The administration of Claudia Sheinbaum is looking to partially reverse this curve with what’s being called the Mexico Plan. The premise is to substitute a portion of Asian imports with national or regional production. The economy ministry has suggested that up to 30% of current Asian imports, with an emphasis on China, could be replaced by North American sources. At the same time, the executive branch has proposed amendments to the General Import and Export Tax Law to raise tariffs on 1,463 categories across 19 industries—amounting to about $52 billion—targeting countries with no free trade agreements, including China, South Korea, India, and Thailand. The finance ministry estimates that if Mexico substituted just 10% of imported inputs with domestic production, potential GDP would rise by around 1.7%-1.8%.

The design of this strategy is nuanced. Higher tariffs could provide more room for local and North American suppliers, but also risk raising input costs for exporters, with the potential for higher prices and shrinking margins versus Asian and European competitors. For substitution to work without eroding competitiveness, experts highlight the need for complementary measures: financing for SME suppliers, regulatory certainty, technical talent development, and improvements in logistics.

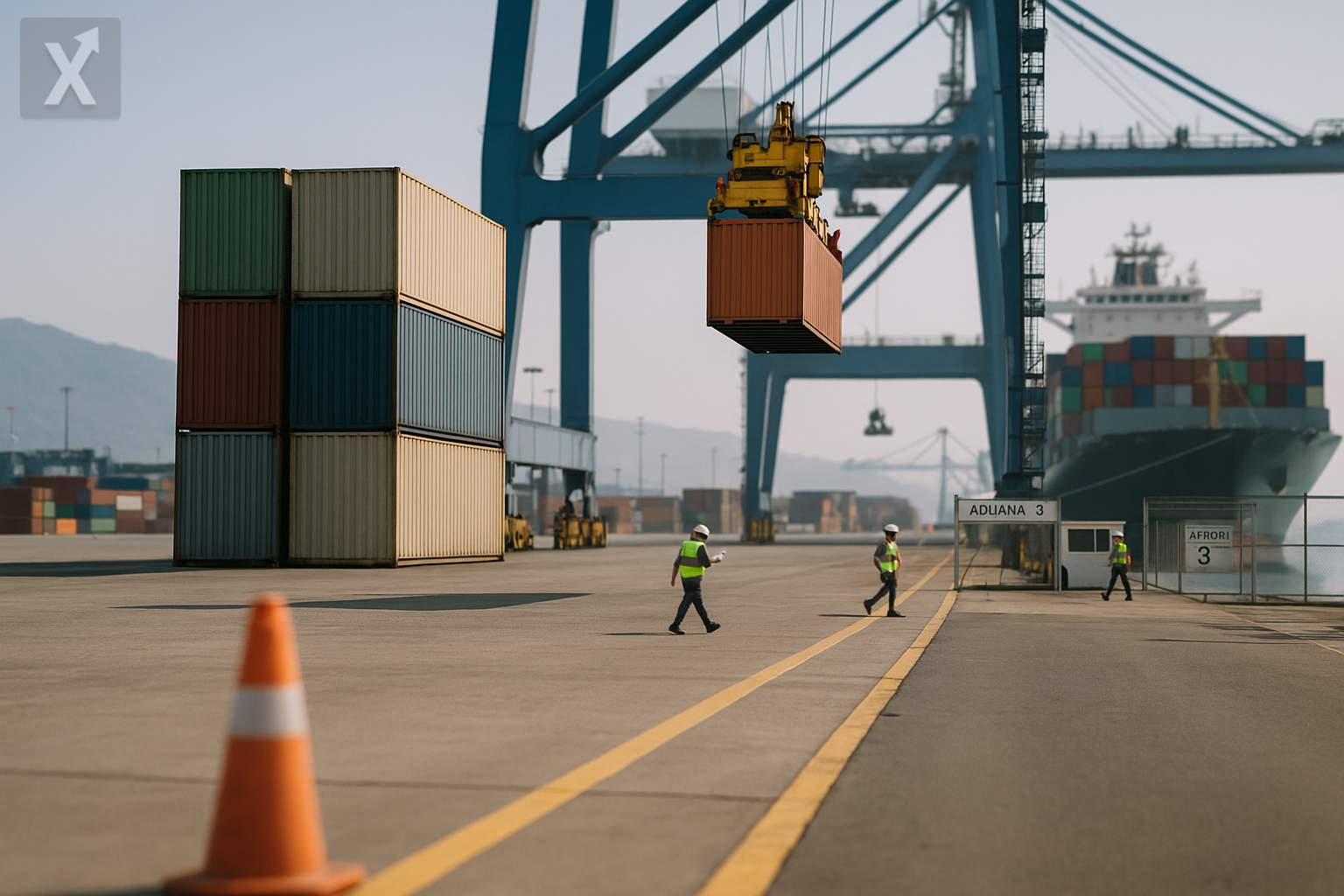

Infrastructure will be key. Pacific ports—Manzanillo and Lázaro Cárdenas—have absorbed the bulk of Asian cargo; their expansion, along with increased rail capacity to the Bajío and north, could reduce costs and turnaround times. In energy, nearshoring-driven manufacturing requires a reliable, sufficient, and increasingly clean power supply. Projects to expand transmission networks, increase renewable capacity, and design tailored supply schemes for industrial parks will impact both the speed and the depth of substitution.

This shift is also part of a broader global reconfiguration of supply chains. The United States and Canada have launched multiple initiatives to reduce their dependence on China, with industrial incentives that foster regional manufacturing. Mexico has room to capitalize on this strategy under USMCA, but faces strict labor and environmental commitments, and a 2026 agreement review that could redefine rules of origin and compliance disciplines. Oversight of transshipment and source origin has intensified, especially in steel, textiles, and chemicals—areas under frequent antidumping investigations and verifications.

At the macro level, the peso’s depreciation compared to pre-election 2024 has increased the peso cost of imports—a factor that could favor local substitution but puts pressure on industries heavily reliant on imported inputs. With general inflation easing from its recent peaks and a cautious monetary policy, the challenge is to sustain disinflation without stalling investment linked to nearshoring. Fixed investment and inflows of productive capital remain strong, but the trade deficit with Asia is still wide: in 2024 it reached $223.35 billion, with over $119 billion attributable to China.

Sector-specific opportunities include deepening linkages in auto parts, electronics, medical equipment, machinery, and, gradually, higher-value processes such as advanced assembly, semiconductor testing and packaging, and battery components. Supplier development programs, public procurement that favors domestic content, credit from Nafin and Bancomext, and certainty in permits and rule of law are all crucial for more Mexican firms to move up the value chain.

In summary, the shift in the origin of imports toward Asia confirms a productive reality: Mexico exports complex manufactures, but relies heavily on Asian inputs to assemble them. The government’s effort to rebalance this equation opens up an opportunity to strengthen local suppliers and North American integration. Its success will depend on execution: more infrastructure and energy, clear rules, and close coordination with the U.S. and Canada—without sacrificing the competitiveness that underpins Mexico’s export dynamism today.

Final note: Asia is now the main source of inputs for Mexican industry; the government’s response blends tariffs with a push to boost domestic supply. There is significant potential, but room for maneuver is tight: substitute without raising costs, integrate without closing off, and leverage nearshoring opportunities before the 2026 USMCA review.