Finance Ministry Clarifies That Lower Remnants from Banxico Will Not Impact Economic Projections

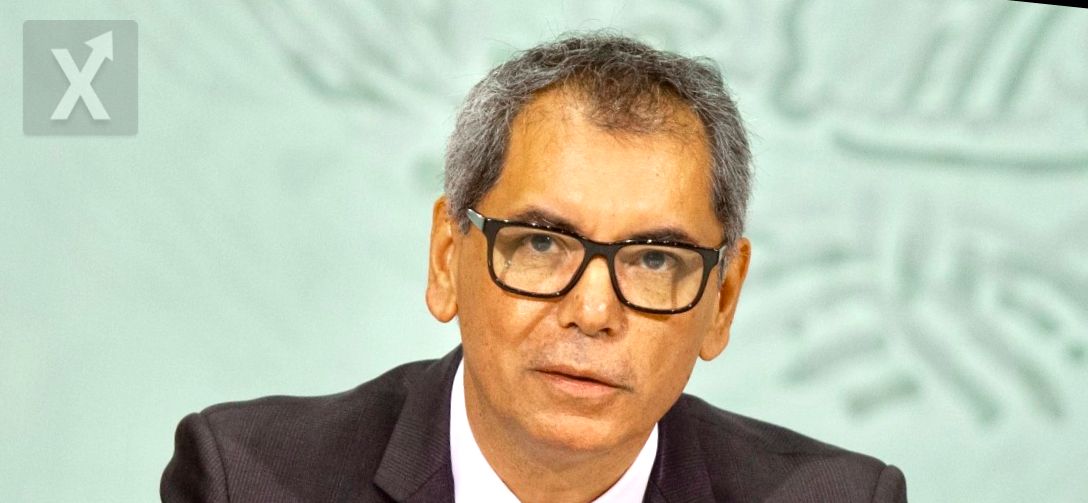

The Ministry of Finance and Public Credit ( SHCP ) and the Presidency had expected that the surplus from the Bank of Mexico (Banxico) would be higher; however, this will not affect economic projections or public finances, said the head of the agency, Edgar Amador Zamora.

“The president mentioned in the conference that we were expecting more, but it’s important to note that the budget projections do not account for estimates regarding the bank's operational surplus; therefore, this does not alter our closing projections for revenues or expenditures,” Amador Zamora explained during a press conference while presenting the first quarter report on finances and public debt. Recently, Banxico announced its profits for 2024, which reached 836.766 billion pesos, resulting in a transfer of 18 billion pesos to the Finance Ministry. Citi Mexico had projected 170 billion pesos, while Banamex estimated 110 billion pesos, meaning that the amount delivered by the central bank only represented 10% of what was expected. “Regarding the use of the operational surplus from the Bank of Mexico, I understand that the deadline for its transfer is by the end of April, though we have yet to confirm if it has already reached the Finance accounts,” Amador Zamora commented to the press. Rodrigo Mariscal, chief economist at the SHCP, explained that Article 19 Bis of the Federal Budget and Fiscal Responsibility Law outlines three points regarding the operational surplus. “The first is that at least 70% of that surplus must be allocated to debt payment or improvement of annual financing; the second point states that the difference, whether it’s 70% or up to 100% of what is utilized, should go to the Stabilization Fund for Budgetary Revenues, or strengthen the federal government’s financial position,” the economist detailed. The third aspect indicates that the SHCP has until the last quarterly report of the year to present how these resources will be applied in public finances, meaning “we will have until January 2026 to disclose how these funds will be used,” Mariscal added. According to information from the Finance Ministry, the surplus of 18 billion pesos represents 5.9% or one-seventeenth of the financial cost incurred in the first quarter of the year, which was 302.746 billion pesos. Additionally, this surplus accounts for 11.3% or almost one-ninth of the Financial Requirements of the Public Sector (fiscal deficit) reported at the end of March, which stood at 159.227 billion pesos.

It is crucial for the government to maintain fiscal discipline despite the expectations of lower remnants, as this could generate uncertainty in the markets. The ability to effectively manage public finances is an essential factor in ensuring a stable economic environment that is attractive for investment. It's an important time to review and adjust economic projections and continue on the path of responsible resource management.